Bookkeeping Leads: Proven Lead Generation Strategies for Bookkeepers

Quick Summary

You get consistent bookkeeping client leads when you do two things well.

You pick channels that match your ideal client.

You run a tight qualification and follow-up process.

Here is what matters most.

- A good lead has fit, urgency, and ability to pay.

- The best channels combine trust and repeatability.

- Referrals and partnerships bring the best-fit accounting leads.

- Local SEO wins for bookkeeping leads for small business searches.

- Paid ads and outbound can work fast. They need discipline.

- A 30/60/90-day plan builds pipeline without chaos.

- Better follow-up often beats “more leads.”

Blog Summary / Key Takeaways

- Define “good” before you chase volume.

- Build two channels first. Then add a third.

- Improve conversion with speed, scope, and structure.

- Protect delivery with a repeatable month-end system.

- Use tools like Xenett to standardize close and review.

What Is a “Good” Bookkeeping Lead?

A good lead matches your service and your workflow.

They also have a real reason to act now.

A bookkeeping lead is a contact with a possible need.

A bookkeeping client has qualified, agreed scope, and signed.

Most “bookkeeping leads online” fail for one reason.

The scope stays unclear until late in the process.

That creates three outcomes.

- You underprice the work.

- You overpromise a timeline.

- You start onboarding with missing access and documents.

If you want leads for bookkeeping services that convert,

you must qualify for scope early.

The 5 Signals of a High-Quality Bookkeeping Lead

High-quality bookkeeping client acquisition starts with fit signals.

You can spot them in the first call or form.

- Clear service need: monthly close, cleanup, catch-up, or ongoing.

- Operational maturity: bank feed, system, steady transaction flow.

- Decision access: owner, GM, or CFO joins the conversation.

- Budget alignment: they can afford recurring monthly service.

- Timing: they have a deadline or a pain trigger.

Timing triggers show up often.

- Tax handoff needs clean books.

- A lender asks for monthly reporting.

- A new location increases volume.

- Sales tax or payroll filings fall behind.

For example, a funded ecommerce brand often calls after a raise.

They need monthly close and reporting before a board meeting.

That lead usually values speed and accuracy over the lowest price.

Red Flags That Waste Time

Low-fit leads look urgent. They often resist structure.

They also treat your service like commodity labor.

Watch for these red flags.

- “Just categorize everything” with no access or systems.

- “We need it done yesterday” but they delay documents.

- They want tax and advisory for bookkeeping rates.

- High complexity, but no budget for cleanup and controls.

You can still help some of these prospects.

However, you must route them to the right entry offer.

A paid cleanup first often protects your team and margins.

How Bookkeeping Lead Generation Works

Bookkeeping lead generation works like a simple funnel.

Visibility brings attention. Trust builds confidence.

Conversion turns interest into signed work.

The Bookkeeping Lead Funnel

Visibility means prospects can find you.

This includes SEO, referrals, partnerships, ads, and outbound.

Trust means they believe you can deliver.

Proof and positioning build trust fast.

Conversion means your process closes the deal.

Qualification, proposal, and onboarding do the work here.

This funnel matters because bookkeeping stays operational.

Prospects want reliability. They fear mistakes and surprises.

Trust signals that help.

- Clear scope and boundaries

- Reviews and specific outcomes

- Industry focus

- A visible month-end approach

For example, many buyers ask one question first.

“How do you handle month-end close?”

If you answer with a clear process, they relax.

Why “More Leads” Usually Isn’t the Problem

Most firms do not have a lead problem.

They have a conversion and delivery problem.

Common bottlenecks look like this.

- unclear packages and no scope boundaries

- weak qualification and no fit scoring

- slow follow-up and missed contact windows

- inconsistent proposals and onboarding steps

Response time matters more than people admit.

Many service businesses win by replying first.

Inbound vs. Outbound Bookkeeping Leads: Which Strategy Fits Your Firm?

Inbound and outbound both work for accounting leads.

They work differently. They also break differently.

Inbound Leads

Inbound leads come to you.

They find you through search, reviews, content, and referrals.

Pros

- Higher trust and better close rate

- Compounding returns over time

- Strong for bookkeeping leads for small business searches

Cons

- Slower ramp than outbound or paid

- Needs consistency in content and local signals

- Requires patience and tracking

Inbound also filters for intent.

Someone searching “monthly bookkeeping service near me”

often needs help now.

Outbound Leads

Outbound means you start the conversation.

You target a niche and reach out with a reason.

Pros

- Faster pipeline creation

- Strong niche targeting

- Works well with trigger events

Cons

- Requires messaging discipline

- Needs follow-up structure

- Can create “maybe later” volume

Outbound fails when it sounds generic.

It works when you name a specific operational problem.

Best Use Cases by Firm Stage

Pick strategy by stage and capacity.

Do not copy a firm that has a different team size.

- Solo or new firm: referrals, local SEO, partnerships

- Growing firm (10–100 clients): niche content, targeted outbound

- Scaling (100–500+ clients): diversify channels and tighten ops

At scale, conversion ops matter most.

You must protect month-end. Therefore, capacity planning matters.

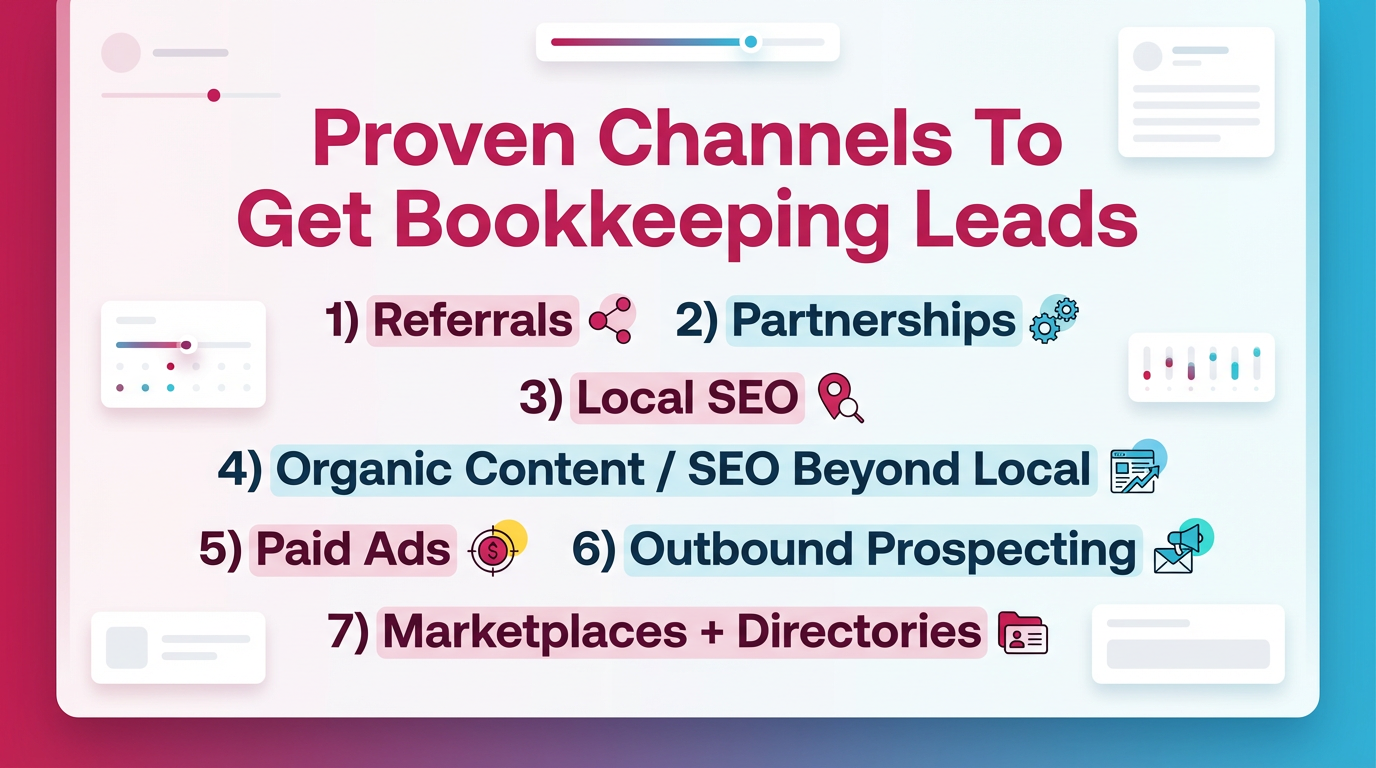

Proven Channels To Get Bookkeeping Leads

You need channels that match your ideal client profile.

You also need channels you can sustain.

Below are seven channels that work in 2026.

Each one can produce bookkeeping client leads.

1) Referrals

Referrals stay the best source of high-fit leads.

They arrive with trust and context.

How To Make Referrals Systematic

You can systematize referrals with three sources.

- existing clients

- CPAs and tax pros

- fractional CFOs and consultants

Make the ask specific.

Name the niche and the timing trigger.

Examples of clear triggers.

- “Books are two months behind.”

- “They need monthly close before bank reporting.”

- “They need a cleanup before tax prep.”

When you ask broadly, people forget.

When you ask specifically, people remember.

Referral Ask Script

Keep it short. Make it easy to forward.

Hi [Name]. Quick ask.

I help [niche] businesses that struggle with [trigger].

Typical case is [example: cleanup + monthly close in QBO].

Do you know one owner who needs help before [deadline]?

If yes, I can send a short intro note you can forward.

Common Referral Mistake

The common mistake is this line.

“Send anyone who needs bookkeeping.”

That forces the referrer to do the thinking.

It also creates low recall and low-fit intros.

2) Partnerships

Partnerships can create steady lead generation for accountants.

They also improve retention through better handoffs.

Best Partnership Types for Lead Generation for Accountants

Partnerships work best when incentives align.

Look for partners who want clean books, not more work.

Good partner types include.

- tax firms that do not want bookkeeping

- payroll providers with client cleanup pain

- fractional CFOs who need monthly close reliability

- banks and lenders that push for better reporting

- agencies that need accurate job costing

Payroll partnerships work for a clear reason.

Mis-posted payroll breaks reconciliations and reports.

That pain repeats every month.

Partnership Operating Model

Treat partnerships like a process, not coffee meetings.

- Define shared client profile.

- Align on handoff points and timing.

- Agree on communication cadence.

- Track outcomes and quality.

Handoff points should feel operational.

For example: cleanup → monthly close → tax-ready package.

Common Mistake

The common mistake is no handoff package.

Leads arrive messy and unmanaged.

Scoping becomes painful and slow.

Create a simple intake standard.

- system and access

- how far behind

- payroll and sales tax status

- bank accounts and credit cards count

- inventory or job costing needs

3) Local SEO

Local SEO often wins for steady inbound.

It matches high-intent searches near you.

What Local SEO Needs To Work in 2026

Local SEO needs basics done well.

It also needs steady review flow.

Key elements.

- complete Google Business Profile

- consistent NAP citations

- location and service pages by intent

- review velocity and responses

Local SEO Checklist

Use this checklist to build traction.

- GBP: services, description, FAQs, photos, posts

- Reviews: request workflow and quarterly targets

- Landing pages: niche and location pages when relevant

- Tracking: calls, forms, booked consults

Review velocity matters because it signals freshness.

Do not batch review asks once a year.

Ask at moments of value, like after a clean close.

Common Mistake

The common mistake is a generic page.

It says “Bookkeeping Services” and nothing else.

That page does not rank well.

It also does not convert well.

Add specifics.

- who you help

- what systems you support

- what “done” looks like at month-end

- how you handle cleanup and backlog

4) Organic Content / SEO Beyond Local

Organic SEO brings compounding bookkeeping leads online.

It works best when content matches buyer intent.

The 3 Content Types That Generate Qualified Bookkeeping Leads Online

Create content that maps to purchase decisions.

Do not write generic bookkeeping tips only.

Use these three types.

- Problem pages: cleanup, catch-up, close backlog, reconciliations

- Niche pages: “bookkeeping for contractors,” “for dentists,” and more

- Comparison pages: pricing models and what’s included

Problem pages attract urgency.

Niche pages attract fit.

Comparison pages attract buyers ready to choose.

Keyword Clusters to Target

Build clusters that match searches you want.

These support how to find bookkeeping clients at scale.

Include terms like.

- how to get leads for bookkeeping

- bookkeeping marketing strategies

- bookkeeping client acquisition

- how to find bookkeeping clients

- lead generation for accountants

- bookkeeping leads online

Also cover adjacent terms.

- bookkeeping client leads

- accounting leads

- how to get bookkeeping clients

- how to get new clients accounting firm

Content Gap to Exploit

Most top posts talk about marketing tactics only.

They skip qualification and delivery readiness.

Add what others miss.

- clear qualification criteria

- a repeatable sales process

- follow-up cadence

- capacity and onboarding readiness

Here is a practical example from the field.

Many firms publish “bookkeeping pricing” pages.

Few explain what drives cost in plain English.

Transaction volume and cleanup status drive cost most.

That simple clarity filters low-fit leads early.

5) Paid Ads

Paid ads can produce fast bookkeeping client acquisition.

They can also waste money without tight conversion steps.

When Paid Ads Make Sense

Paid ads make sense when three things exist.

- clear service packages

- fast response SLA

- a conversion landing page

Do not send traffic to your homepage.

Send it to a page that answers one intent.

What To Bid On

Bid on high-intent searches.

- “bookkeeping services near me”

- “monthly bookkeeping service”

- “QuickBooks Online bookkeeper”

- “bookkeeping cleanup service”

Avoid broad terms at first.

“Accounting services” often brings mismatched needs.

It can also bring tax-only shoppers.

Ads Funnel

Keep the funnel simple.

Search ad → niche landing page → short form → scheduled call → qualification.

Your form should pre-qualify.

Ask for the system, revenue range, and timing.

This improves leads for bookkeeping services quality.

Common Mistake

The common mistake is weak landing pages.

No proof. No scope clarity. No expectations.

Anchor the scope with examples.

- monthly close timeline

- what client provides and when

- cleanup pathway if books lag

6) Outbound Prospecting

Outbound works when you target triggers.

It fails when you spray generic pitches.

Best Outbound Targets for Bookkeeping Client Leads

Use targets with visible need signals.

- hiring for finance admin roles

- funded SMBs in growth mode

- industries with compliance pressure

Industries with recurring volume include.

- ecommerce

- contractors

- multi-location services

- medical practices

The goal is not more contacts.

The goal is better-fit accounting leads.

Outbound Sequence Framework

Use a short sequence.

Do not over-automate early.

- Identify ICP and trigger.

- One-sentence value statement with proof.

- Ask a specific question.

- Follow up 3–5 touches in 2 weeks.

A specific question sounds like this.

“Are you closing the books by the 10th each month today?”

That opens a real conversation about month-end.

Common Mistake

The common mistake is pitching “bookkeeping” as a category.

Prospects hear that as a commodity.

Name the operational problem instead.

Late close. Messy reconciliations. Reporting delays.

7) Marketplaces + Directories

Directories can bring volume fast.

They often bring lower-fit inquiries too.

Where Directory Leads Fit

Directory leads fit best in two cases.

- you need early pipeline testing

- you have a strong filter and intake

Treat directories as top-of-funnel.

Do not build your whole model on them.

How To Filter and Improve Lead Quality

Add friction to protect your time.

Require details before a call.

- system used (QBO or Xero)

- monthly revenue range

- transaction volume

- timing and deadline

- cleanup status

Offer two pathways.

- paid cleanup first

- monthly bookkeeping after stabilization

This protects your team and your margins.

It also sets clear expectations.

“Free Bookkeeping Leads” Reality Check

Free bookkeeping leads rarely stay free.

You pay with time, scope creep, and no-shows.

Test them, but do not rely on them.

Use them to sharpen your intake questions.

Compare Lead Channels: Quality, Time-to-Results, and Operational Load

Use this table to pick your first two channels.

Then add a third once conversion feels stable.

A Repeatable 30/60/90-Day Plan to Get New Bookkeeping Clients

This plan builds a pipeline without breaking delivery.

It also improves close rate without chasing volume.

First 30 Days: Foundation + Conversion

Start with clarity and speed.

This makes every channel work better.

- Tighten ICP and packages.

- Define what you do and do not do.

- Create one high-converting landing page.

- Add a qualification form.

- Set a response SLA under one business day.

Your landing page should answer these fast.

- Who you help

- What you deliver each month

- What you need from the client

- What happens if books are behind

If you want structure for close delivery,

standardize your month-end steps early.

A checklist per client avoids surprises later.

Days 31–60: Build Lead Flow From 2 Channels

Pick two channels and commit.

Do not start seven at once.

- Launch local SEO basics and reviews process.

- Activate partnerships with 10 outreach notes per week.

- Publish 2–4 high-intent pages or posts.

High-intent pages include.

- catch-up bookkeeping

- cleanup service

- monthly close support

- bookkeeping for your niche

These pages support how to get bookkeeping clients online.

They also pre-qualify before the call.

Days 61–90: Scale What’s Working + Add a Third Channel

Now add controlled volume.

Do it only if onboarding stays smooth.

- Add paid search or outbound based on capacity.

- Track conversion metrics weekly.

- Refine qualification and follow-up.

- Create a simple referral kit for partners.

A referral kit can include.

- who you help

- common triggers

- what you need to start

- a short intro email template

Lead Quality, Conversion, and Follow-Up

You win deals with process, not charisma.

You also protect margins with scope control.

A Practical Qualification Checklist

Use this checklist every time.

It improves consistency across your team.

- System: QBO or Xero. Access ready.

- Complexity: volume, payroll, inventory, multi-entity.

- Timing: why now. What deadline exists.

- Owner involvement: decision-maker present.

- Fit: close expectations and responsiveness.

- Budget: aligned to ongoing service.

Add one more question that saves time.

“Who will gather documents each month?”

If they cannot answer, delivery risk goes up.

Follow-Up Cadence That Actually Converts

Follow-up should feel helpful, not pushy.

It should also feel structured.

- Same day: recap and next steps.

- 48 hours: clarify scope gaps and access needs.

- 7 days: final nudge with one clear option.

That clear option can be.

“Paid cleanup first, then monthly close.”

This keeps scope controlled and sets expectations.

Common Mistake

The common mistake is treating proposals as quotes.

That turns your service into a commodity.

Instead, sell a process and a scope.

Explain what you review, when you close, and how you communicate.

Best Practices for Bookkeeping Marketing Strategies

Marketing should not outrun operations.

If it does, quality drops and churn rises.

Best Practices

Use capacity-based marketing.

Sell what you can deliver repeatedly.

Best practices that work.

- Use scope-first messaging.

- Set clear timelines and client responsibilities.

- Build proof around outcomes, not tasks.

Outcome-based proof examples.

- faster close by a set day

- fewer cleanup cycles

- reliable monthly reporting

Quality-Control Best Practice That Improves Referrals

Quality control drives referrals more than fancy branding.

Clients refer when work feels stable.

Two practical moves help most firms.

- Standard review standards across staff.

- Clean handoffs to tax partners each year.

Partners send more bookkeeping client leads

when your year-end package stays consistent.

Common Mistakes to Avoid

Avoid these traps.

- Taking any client to fill pipeline

- Running ads before onboarding stays consistent

- Overpromising timelines without document discipline

If you promise a five-day close, enforce inputs.

Otherwise, you train clients to delay.

How Xenett Supports Lead-Ready Delivery

Lead generation fails when delivery slips.

Missed closes and messy reviews reduce referrals.

They also create churn in the first 90 days.

Therefore, a predictable close system becomes a growth lever.

Xenett can support that operational layer for your team.

If you want background on Xenett’s focus, start here:

Why This Matters for Lead Generation

Your best bookkeeping marketing strategies should not add chaos.

They should add clients you can serve with consistency.

A consistent month-end process creates.

- better retention

- better reviews

- more referrals

- stronger partner trust

Xenett as an Example of Operationalizing Close and Review Best Practices

Xenett supports accounting workflow, review, and close management.

Xenett is not an audit tool.

Xenett does not provide audit services.

Close Task and Checklist Management

Xenett centralizes recurring close work by client and period.

It helps you define “done” in one place.

This matters when you onboard new clients.

You avoid building ad-hoc processes each time.

Your team follows the same steps each month.

Review and Approval Workflows

Xenett supports structured internal review before you close.

It helps reviewers follow consistent review steps.

That reduces reviewer-to-reviewer variance.

It also helps new staff learn your standards faster.

Visibility Into Close Status and Bottlenecks

Xenett provides visibility into work status across clients.

You can see where work gets stuck.

Common bottlenecks include.

- missing documents

- unreconciled accounts

- unresolved questions

Visibility helps you allocate review time earlier.

It reduces last-minute cleanup and rushed work.

FAQ: Bookkeeping Leads

What is the best way to get bookkeeping leads?

Combine one trust channel with one scalable channel.

Use referrals or partnerships for trust.

Use local SEO or targeted outbound for scale.

Then improve conversion with qualification and follow-up.

How do I get leads for bookkeeping services online?

Start with local SEO and high-intent pages.

Build your Google Business Profile and reviews.

Publish service pages for monthly bookkeeping, cleanup, and catch-up.

Avoid generic content that misses buyer intent.

What are the fastest channels for bookkeeping client acquisition?

Paid search and targeted outbound move fastest.

They work only with clear packages and fast response times.

They also need strong qualification to filter low-fit leads.

Are “free bookkeeping leads” worth it?

Sometimes for testing, yes.

They often come with low fit and high time cost.

Treat free bookkeeping leads as experiments, not a core channel.

How do I qualify bookkeeping leads quickly?

Use a short checklist.

System, transaction volume, timing trigger, decision access, and budget.

Also confirm who will provide documents each month.

What should I track to know if lead generation is working?

Track pipeline quality, not volume only.

- lead source

- qualified rate

- booked call rate

- close rate

- time-to-close

- first-90-day churn

How can I attract better bookkeeping leads (not just more)?

Niche positioning and scope clarity attract better-fit buyers.

Add proof like reviews and clear outcomes.

Show your month-end process so clients value reliability.

Conclusion

You can get consistent bookkeeping leads without chasing low-fit inquiries.

Start by defining a good lead.

Then pick two channels you can sustain for 60 days.

Finally, tighten qualification and follow-up.

This week, do three actions.

- Write your ICP and top three timing triggers.

- Build one landing page that states scope and expectations.

- Add a qualification checklist to every first call.

If you want growth that stays stable, protect month-end delivery.

A repeatable close and review process keeps quality high.

It also makes referrals and partnerships easier to earn.

.svg)