Consolidation of Financial Statements: A Step-by-Step Guide

If month-end close feels stressful and confusing, you’re not alone. Consolidation of Financial Statements often turns simple numbers into reports that feel hard to trust and even harder to finish.

If you manage parent and subsidiary data, deal with eliminations, or fix mismatched totals late at night, keep reading. This guide explains consolidation clearly, step by step, without heavy accounting language.

Many finance teams struggle because consolidation feels scattered. For example, one small intercompany mistake can affect the entire consolidated financial statement and delay reporting deadlines.

I once worked with a team that rechecked the same spreadsheet for three days. However, the issue was not skill. The process itself was unclear and too manual.

This guide shows how the consolidation process in accounting really works. Therefore, you can close faster, reduce errors, and feel confident in your consolidated financial statements.

Blog Summary

Consolidation of financial statements combines a parent company and its subsidiaries into one unified financial view.

This blog explains how to prepare a consolidation of financial statements with examples, common challenges, adjustments, and best practices.

You’ll also learn how modern tools like Xenett simplify consolidation and reduce errors.

What Is Consolidation of Financial Statements?

Consolidation of Financial Statements means combining a parent company’s numbers with those of its subsidiaries into one report. It shows the full business as a single company, not separate pieces.

In simple terms, all balance sheets, income statements, and cash flow statements come together. Therefore, investors and leaders see the real financial position of the entire group.

The key idea is clarity. For example, sales between group companies are removed, so revenue is not counted twice. This makes consolidated financial statements more accurate and reliable.

I once reviewed reports where internal sales inflated revenue by millions. However, proper consolidation accounting quickly revealed the true performance of the business group.

Key Elements of the Consolidation Process

Consolidation helps decision-makers understand the full picture. Therefore, they can trust the numbers and act with confidence.

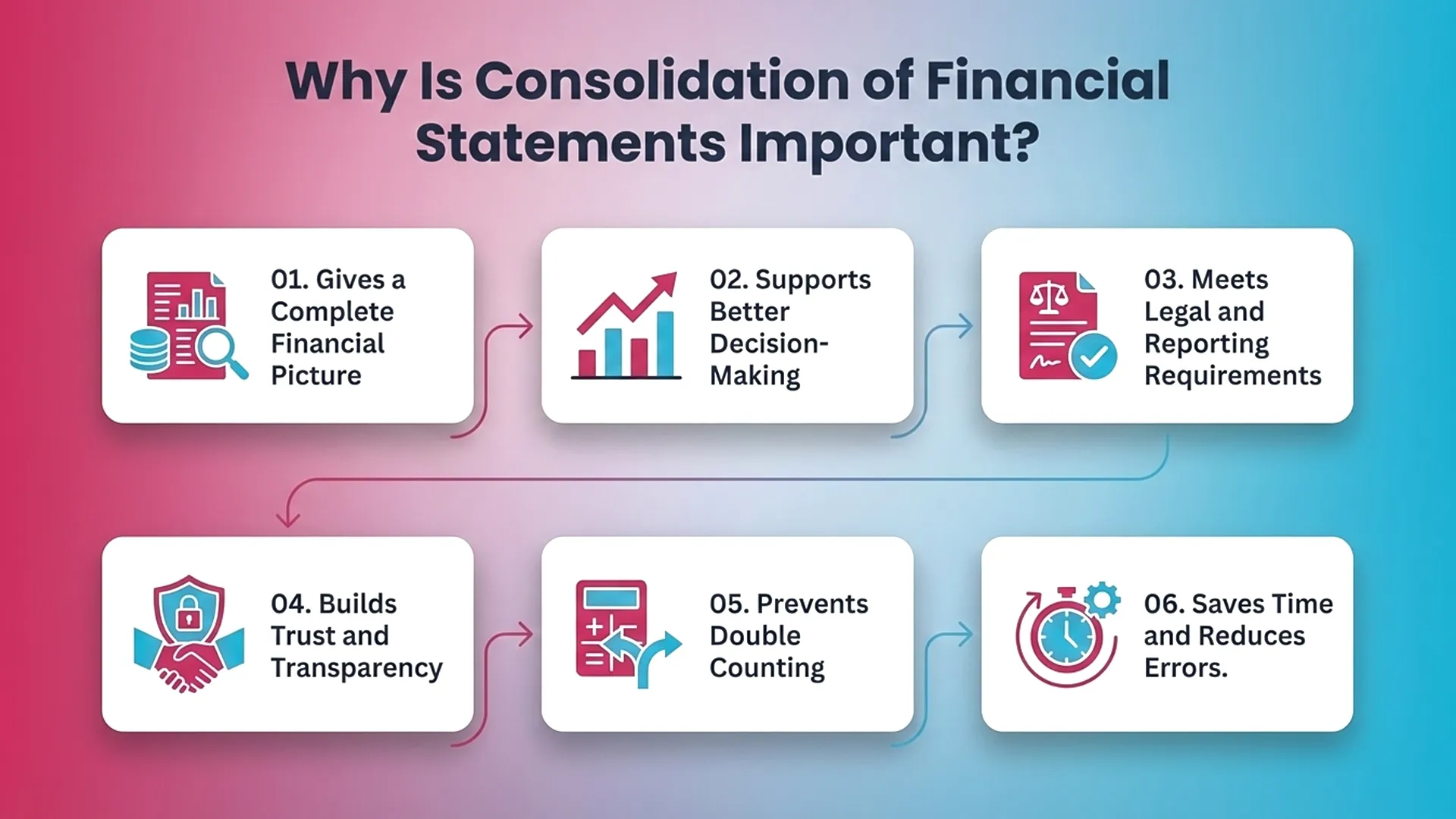

Why Is Consolidation of Financial Statements Important?

Consolidation of Financial Statements is important because it shows the true financial health of a business group. It presents all companies as one, making numbers clearer and easier to trust.

Without consolidation, reports feel incomplete. Therefore, leaders, investors, and lenders may base decisions on partial or misleading information.

Gives a Complete Financial Picture

Consolidated financial statements combine assets, liabilities, revenue, and expenses. For example, this shows how the entire group performs, not just one company within it.

Supports Better Decision-Making

Management relies on consolidated data to plan growth and control risk. However, separate reports can hide losses or overstate profits across subsidiaries.

Meets Legal and Reporting Requirements

Many companies must follow consolidation accounting rules under GAAP or IFRS. Therefore, consolidated reports help businesses stay compliant and avoid penalties.

Builds Trust and Transparency

Clear consolidated financial statements improve confidence among investors and lenders. For example, they show how the group earns money from external customers only.

Prevents Double Counting

Intercompany transactions are removed during consolidation. However, without this step, revenue and assets may appear higher than they really are.

Saves Time and Reduces Errors

A structured consolidation process improves reporting speed. Therefore, teams spend less time fixing errors and more time analyzing results.

- One Business View

Shows the entire group as a single company - Better Decisions

Helps leaders plan using complete financial data - Regulatory Compliance

Meets GAAP and IFRS consolidation rules - Investor Confidence

Builds trust through clear and accurate reporting - No Double Counting

Removes internal sales and balances - Faster Reporting

Reduces manual work and reporting delays

When Is Consolidation Required?

Consolidation of Financial Statements is required when one company controls or strongly influences another. It ensures the business group is reported as one unit, not as disconnected companies.

In simple terms, if you control decisions or finances, consolidation is usually necessary. Therefore, stakeholders see the real financial position of the entire group.

When a Parent Controls a Subsidiary

Consolidation is required when a parent owns more than 50 percent of the voting power. For example, this level of control allows the parent to direct financial and operating decisions.

When There Is Significant Influence

Even without full control, consolidation rules may apply. However, owning around 20 percent or more can give influence over key decisions in associate companies.

In Joint Venture Arrangements

Joint ventures involve shared control between parties. Therefore, financial results must reflect shared responsibility and combined economic impact.

When Laws and Standards Require It

Accounting standards like GAAP and IFRS often require consolidation. Therefore, companies must follow these rules to stay compliant and avoid reporting issues.

Why Consolidation Is Required

Consolidation provides a clear group-level picture. For example, it improves transparency, supports better planning, and prevents misleading financial information.

When Consolidation May Not Apply

In rare cases, consolidation may not be required. However, this happens when strict restrictions block control or when a higher holding company already consolidates results.

Quick Guide: When Is Consolidation Needed?

Methods of Consolidation

When people talk about the Consolidation of Financial Statements, this is where confusion usually starts. Think of consolidation methods as different ways to combine numbers, depending on how much control you actually have.

If I were explaining this to a friend, I’d say this. You don’t use one method for every company. You pick the method that matches your level of ownership and control.

Full Consolidation Method

This method is used when you control the company. For example, if you own more than 50 percent, you include everything.

- Add all assets, liabilities, income, and expenses

- Remove intercompany sales and balances

- Show non-controlling interest separately

This method gives the clearest group-level picture. Therefore, it is the most commonly used approach.

Equity Method

This method applies when you have significant influence but not full control. However, you still need to reflect your share of results.

- Record the investment as a single line item

- Adjust for your share of profits or losses

- Do not combine full financial statements

This keeps reporting simple while staying accurate.

Proportionate Consolidation Method

This method is often used for joint ventures. For example, when control is shared between partners.

- Include only your share of assets and liabilities

- Include your portion of income and expenses

- Avoid overstating group results

This method reflects shared responsibility clearly.

Quick Comparison of Consolidation Methods

Step-by-Step Consolidation Process

The Consolidation of Financial Statements becomes much easier when you follow clear steps. Think of it like cleaning and combining data so everything finally makes sense in one place.

If I were walking a friend through this, I’d say this first. Don’t rush. Each step fixes a specific problem before numbers are combined.

Step 1: Decide What to Consolidate

Start by identifying which companies belong in the group. For example, subsidiaries where you have control must be included in consolidation.

- Identify parent and subsidiary relationships

- Confirm ownership and control

- Define consolidation rules upfront

Step 2: Align Accounting Periods and Policies

All companies must follow the same accounting rules. However, different policies can distort consolidated financial statements.

- Match reporting periods

- Standardize accounting methods

- Use a consistent chart of accounts

Step 3: Collect Financial Data

Next, gather financial data from each entity. Therefore, you start with clean and complete numbers.

- Trial balances

- Income statements

- Balance sheets and cash flows

Step 4: Convert Foreign Currency Results

If subsidiaries use different currencies, convert them first. For example, this ensures results are reported in one common currency.

- Apply correct exchange rates

- Follow translation rules

- Adjust for currency differences

Step 5: Eliminate Intercompany Transactions

This step removes internal activity. However, skipping this causes double-counting.

- Remove intercompany sales and purchases

- Eliminate internal loans and balances

- Adjust unrealized profits

Step 6: Account for Non-Controlling Interest

If ownership is less than 100 percent, separate the outside portion. Therefore, reports stay accurate and fair.

- Calculate minority ownership share

- Present it separately in equity

- Adjust profit allocation

Step 7: Record Goodwill If Required

Goodwill appears during acquisitions. For example, it reflects value beyond net assets.

- Compare purchase price to fair value

- Record goodwill or gain

- Remove pre-acquisition equity

Step 8: Prepare Consolidated Statements

Now everything comes together. Therefore, final reports reflect the entire group.

- Consolidated balance sheet

- Consolidated income statement

- Consolidated cash flow statement

Step 9: Review and Report

Always review before sharing results. However, small errors can still slip through.

- Check accuracy and compliance

- Add disclosures and notes

- Share reports with stakeholders

Step-by-Step Consolidation Overview

Common Mistakes to Avoid During Consolidation of Financial Statements

Consolidation of Financial Statements can feel repetitive and exhausting when the same mistakes keep showing up. Most of these errors also appear in the Common Challenges in the Consolidation of Financial Statements, slowing down close cycles.

Here’s a clear, numbered breakdown to keep things simple and readable.

1. Forgetting Intercompany Eliminations

This is the most common mistake. For example, internal sales or loans inflate revenue when not removed during consolidation.

2. Using Different Accounting Policies Across Entities

When subsidiaries follow different rules, results stop making sense. Therefore, policies must be aligned before combining numbers.

3. Not Matching Reporting Periods

If one company reports monthly and another quarterly, problems appear. However, consolidation requires the same reporting period for all entities.

4. Calculating Non-Controlling Interest Incorrectly

Small NCI errors create big reporting issues. For example, equity and profits may look higher than they actually are.

5. Rushing Foreign Currency Conversions

Currency translation is often rushed near deadlines. Therefore, incorrect exchange rates can distort consolidated financial statements.

6. Depending Too Much on Spreadsheets

Spreadsheets work at first. However, as entities grow, manual consolidation causes the same issues seen in Common Challenges in the Consolidation of Financial Statements.

7. Skipping the Final Review

Teams trust numbers too quickly when time is tight. However, skipping reviews leads to audit questions and last-minute fixes.

Frequently Asked Questions (FAQs)

1. What is the consolidation of financial statements?

Consolidation of Financial Statements combines a parent company and its subsidiaries into one financial report showing the group as a single business.

2. Who needs to prepare consolidated financial statements?

Any company that controls another company must prepare consolidated financial statements.

3. Which statements are included in consolidation?

The balance sheet, income statement, and cash flow statement are included.

4. Why are intercompany transactions eliminated?

They are eliminated to avoid double-counting revenue, assets, and expenses.

5. What is non-controlling interest?

It is the portion of a subsidiary not owned by the parent company.

6. When does goodwill arise in consolidation?

Goodwill arises when the purchase price exceeds the fair value of net assets.

7. Can consolidation be done manually?

Yes, but manual consolidation increases errors and reporting time.

8. How often are consolidated financial statements prepared?

They are usually prepared monthly, quarterly, or annually.

Conclusion

Consolidation of Financial Statements does not have to feel like solving a puzzle at midnight with cold coffee. When done correctly, it simply shows the true financial position of the entire business group.

By knowing when consolidation is required, choosing the right method, and following clear steps, teams can avoid unnecessary confusion and rework. Therefore, fewer spreadsheets and fewer headaches become part of the process.

With consistent practices and careful reviews, consolidation turns from a stressful task into a routine one. And yes, closing on time without panic is actually possible.

.svg)

.jpg)