What Is Bookkeeping Practice Management Software? A Beginner’s Guide for Accounting Firms

Still spending late nights chasing spreadsheets, fixing tiny errors, and juggling a dozen apps just to close the books?

Sounds familiar, right?

The truth is, the wrong bookkeeping practice management software can quietly drain your time, patience, and sanity.

In 2025, staying efficient, accurate, and ahead of deadlines isn’t optional... It’s a must.

But don’t worry :)

Let’s talk about what actually works.

In this blog, you’ll discover the best practice management software for accountants and bookkeepers, the tools that actually make life easier, and how to choose the right ones for your firm.

What is Bookkeeping Practice Management Software?

Bookkeeping practice management software is the command center for accounting and bookkeeping firms.

It goes beyond basic bookkeeping apps by combining task management, workflow automation, client communication, document sharing, and reporting...all in one platform.

Think of it as the difference between juggling five different tools versus having a single dashboard that actually keeps your team (and your sanity) intact.

Why the Right Bookkeeping Practice Management Software Matters in 2025

In 2025, efficiency isn’t just a nice-to-have for accounting firms, it’s the difference between thriving and barely keeping up.

The right bookkeeping practice management software has become a cornerstone for delivering accuracy, speed, and a stress-free client experience.

Nobody wakes up thinking, “Oh, I can’t wait to spend the day chasing missing spreadsheets and triple-checking reconciliations!”

If that sounds like you (or your team), it’s probably a sign you’re relying on outdated tools or worse, a messy combo of apps that don’t talk to each other.

Here’s the thing:

The Stakes Are Higher Than Ever

- Clients want instant updates, not “I’ll email you the report next week.”

- Compliance deadlines? They’re tighter, with less room for error.

- And let’s not forget, AI and automation are raising the bar. Firms that don’t adapt risk looking like they’re still stuck in 2010.

Why Your Software Choice Matters

The right tool doesn’t just “store files” or “track tasks.” It:

- Automates repetitive work so your team can focus on strategy.

- Keeps projects, deadlines, and communication in one place (instead of 10 tabs open in Chrome).

- Protects client data with compliance-ready security.

- Scales with you... so whether you’re managing 10 clients or 1,000, you’re not constantly duct-taping new apps together.

Think of it this way: your practice management software is like your firm’s GPS.

Without it, you’re not just lost... you’re probably circling the same roundabout, wasting fuel, time, and patience.

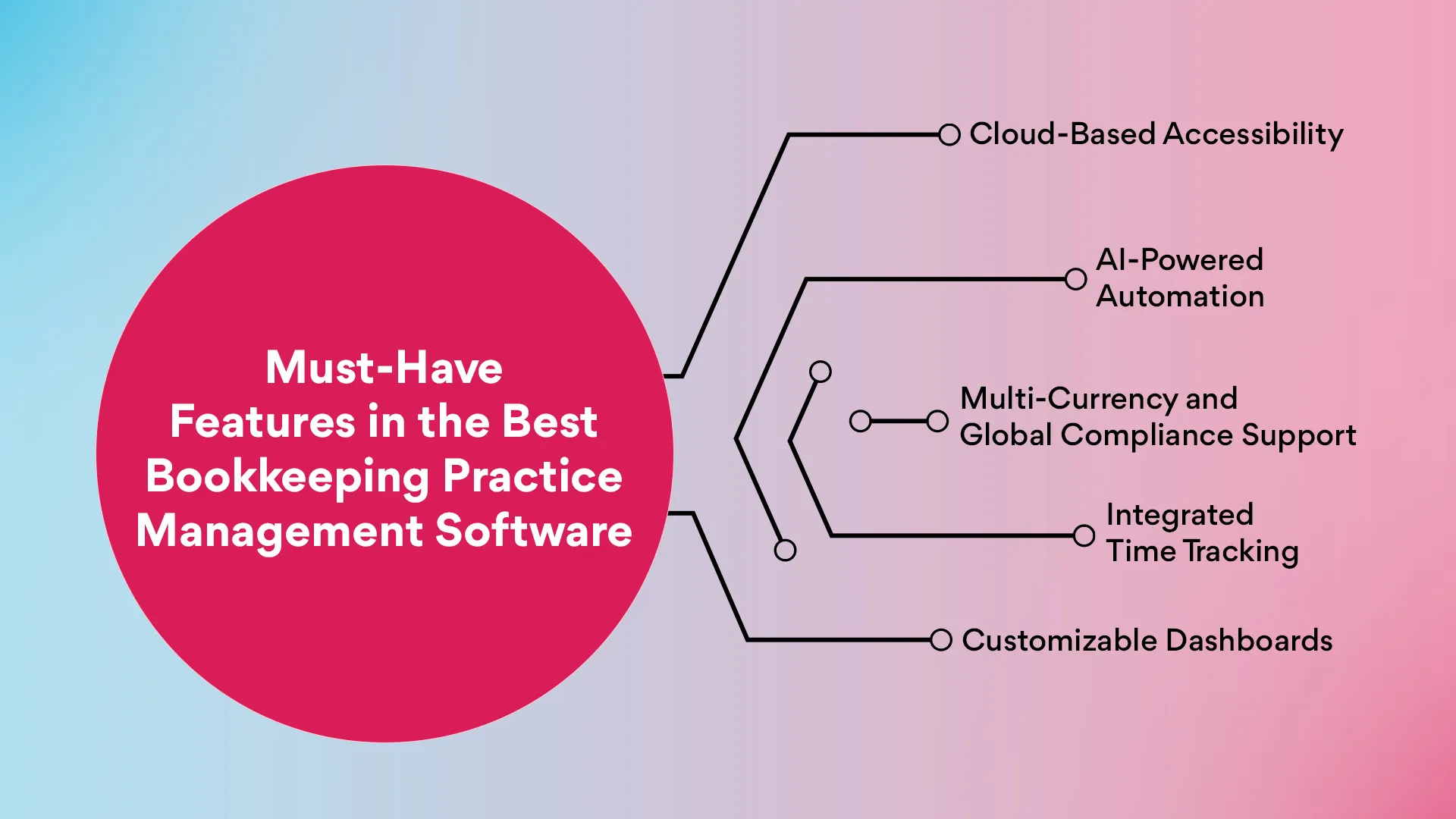

Must-Have Features in the Best Bookkeeping Practice Management Software

The best bookkeeping practice management software isn't just about ticking boxes...

It’s about transforming your firm’s operations and ensuring accuracy across everything from daily workflows to the balance sheet.

Let’s explore the essential features that can elevate your practice:

1. Cloud-Based Accessibility

Gone are the days of being tethered to a single workstation. Cloud-based solutions offer:

- Remote Access: Work from anywhere, ensuring flexibility for you and your team.

- Real-Time Collaboration: Share and edit documents simultaneously, streamlining teamwork.

- Automatic Updates: Stay current with the latest features and security patches without manual intervention.

2. AI-Powered Automation

Embrace the future with AI-driven tools that:

- Automate Repetitive Tasks: Let the accounting software handle invoicing, data entry, and report generation.

- Enhance Accuracy: Reduce human errors with intelligent data processing.

- Provide Insights: Utilize predictive analytics for better decision-making.

3. Multi-Currency and Global Compliance Support

For firms with international clients, these features are crucial:

- Multi-Currency Handling: Manage transactions in various currencies seamlessly.

- Tax Compliance: Stay updated with global tax regulations and ensure accurate reporting.

- Localized Features: Cater to specific regional requirements, enhancing client satisfaction.

4. Integrated Time Tracking

Efficient time management is key:

- Track Billable Hours: Ensure accurate billing by monitoring time spent on tasks.

- Monitor Productivity: Identify areas where efficiency can be improved.

- Generate Reports: Provide clients with detailed time logs for transparency.

5. Customizable Dashboards

Stay organized with:

- Personalized Views: Tailor dashboards to display relevant metrics and tasks.

- Quick Access: Navigate through your most-used features effortlessly.

- Real-Time Updates: Receive instant notifications on project statuses and deadlines.

Top 6 Bookkeeping Practice Management Software for 2025

Bookkeeping practice management software can make the difference between smooth workflows and a chaotic mess of spreadsheets, emails, and missed deadlines.

Let’s break down the top tools and what makes them stand out...

1. Xenett

Work Management

- AI-powered workflow automation to reduce manual tasks.

- Customizable templates for recurring projects.

- Centralized dashboard for all client work.

Time Tracking & Billing

- Track team hours effortlessly.

- Auto-generate invoices based on tracked time and tasks.

Collaboration

- Real-time team communication inside tasks.

- Automated reminders for deadlines.

- Secure client portal for file sharing and updates.

Reporting

- AI-driven financial review and reporting.

- Detailed insights on productivity, task completion, and deadlines.

- Custom dashboards for management overview.

User-Friendliness

- Clean, intuitive interface.

- Easy for teams to adopt quickly without a learning curve.

2. Karbon

Work Management

- Fully integrated emails – Connect Microsoft Office 365 or Gmail to manage emails within Karbon. Assign emails to colleagues, log them against projects, and never lose track again.

- Automated tasks & emails – Set rules so tasks are automatically created or emails are sent based on triggers.

- Template library – Huge library of customizable workflow templates.

- Kanban board – Visual overview of tasks and statuses.

- Tasks & subtasks checklist – Break projects down into manageable chunks.

Time Tracking & Billing

- Simplistic time tracking integrated with tasks.

- Track billable hours without juggling spreadsheets.

Collaboration

- Assign emails/tasks to team members easily.

- Automated reminders for deadlines.

- Task communication with mentions, comments, and assignments.

Reporting

- Track task status: started, completed, overdue.

- Average time to complete tasks.

- Leaderboard: open work, completed, overdue.

- Time and budget estimates for planning.

User-Friendliness

- Intuitive interface with basic workflow automation.

- Easy adoption for teams of all sizes.

3. TaxDome

Work Management

- Client portal for document uploads and e-signatures.

- Workflow automation to reduce repetitive manual tasks.

- Project templates to standardize recurring processes.

Time Tracking & Billing

- Track billable hours and convert them into invoices automatically.

Collaboration

- Internal messaging to communicate with team members.

- Client communication through a secure portal.

Reporting

- Monitor project progress and task completion rates.

- Customizable dashboards for financial oversight.

User-Friendliness

- Clean interface with drag-and-drop workflows.

- Minimal training required for new team members.

4. Canopy

Work Management

- Task management with automated reminders.

- Workflow templates for standard processes.

- Document storage & secure sharing.

Time Tracking & Billing

- Billable hours tracked within client projects.

- Automatic invoice generation.

Collaboration

- Built-in CRM for client communications.

- Team collaboration on tasks with status updates.

Reporting

- Insights on team productivity and workload.

- Customizable reports for management review.

User-Friendliness

- Intuitive dashboard with simple navigation.

5. Jetpack Workflow

Work Management

- Unlimited workflow templates.

- Automate recurring tasks.

- Client management in one centralized place.

Time Tracking & Billing

- Track time directly on tasks.

- Convert tracked time to client invoices.

Collaboration

- Assign tasks to team members.

- Comment and update task progress.

Reporting

- Task completion reports.

- Monitor overdue tasks and productivity metrics.

User-Friendliness

- Minimal learning curve.

- Mobile-friendly for access on-the-go.

6. Financial Cents

Work Management

- Centralized workflow with automation of recurring tasks.

- Track project progress from start to finish.

Time Tracking & Billing

- Track billable hours and link them to invoices.

- Monitor budget vs. actual hours.

Collaboration

- Streamlined client communication.

- Team updates on task status.

Reporting

- Task completion metrics.

- Insights into team performance and efficiency.

User-Friendliness

- Simple interface designed for accountants.

- Easy onboarding with minimal training.

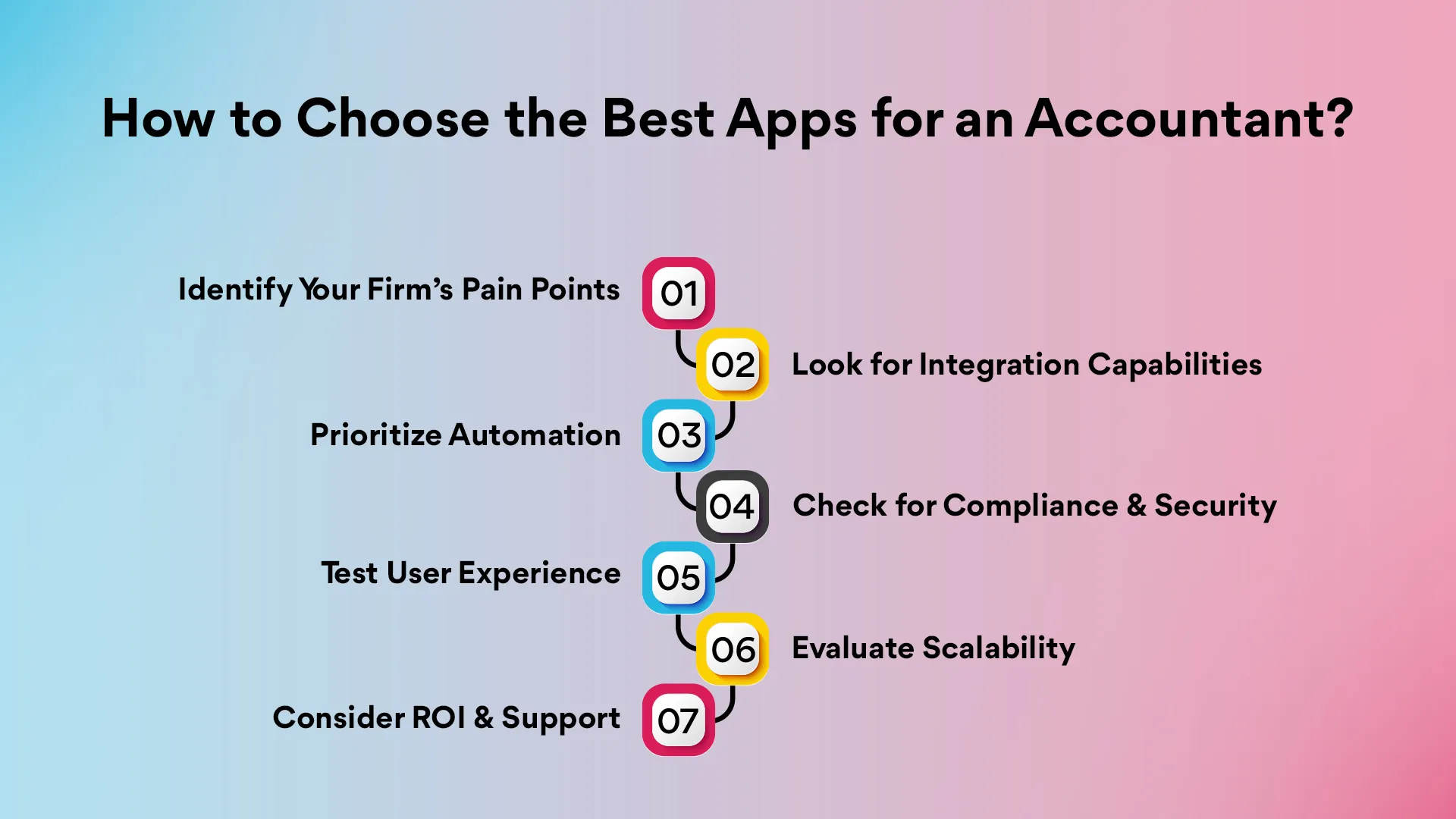

How to Choose the Best Apps for an Accountant?

Choosing the right apps for an accountant isn’t like picking a new coffee mug.

One wrong choice, and suddenly your workflows are a jumbled mess, your team is frustrated, and clients are tapping their fingers waiting for reports.

That’s why it’s important to look beyond surface features—prioritize tools that streamline communication, simplify document management, and integrate smoothly with your existing accounting workflows. Here’s how to make a smart choice without losing your sanity:

1. Identify Your Firm’s Pain Points

Before you scroll through endless app lists, ask yourself:

- Are spreadsheets still haunting you at 10 PM?

- Are manual approvals slowing down client deliverables?

- Do you need better client communication tools?

Knowing what actually slows your firm down helps you focus on solutions that really matter.

2. Look for Integration Capabilities

Nothing kills efficiency like apps that don’t talk to each other.

- Make sure your bookkeeping practice management software connects with your accounting tools, CRM, email, and time-tracking apps.

- Bonus points if the software syncs automatically and reduces duplicate data entry.

3. Prioritize Automation

The less your team has to do manually, the better. Look for:

- Automated workflows for recurring tasks.

- AI features that flag errors or suggest insights.

- Auto-generated reports that save hours every month.

4. Check for Compliance & Security

Accounting isn’t just about numbers...it’s about trust.

- Ensure the software is compliant with tax regulations in your region.

- Look for features like secure client portals, encryption, and audit trails.

5. Test User Experience

You can have the fanciest app on the planet, but if your team struggles to use it, adoption fails.

- Look for intuitive dashboards and simple navigation.

- Trial versions or demos are invaluable...spend time clicking around before committing.

6. Evaluate Scalability

Your firm isn’t static; it grows.

- Will the software handle 10 clients or 1,000?

- Can you add modules or integrate new tools as your needs evolve?

7. Consider ROI & Support

- Cheaper isn’t always better. Factor in time saved, error reduction, and client satisfaction.

- Ensure there’s responsive customer support...preferably with accounting expertise.

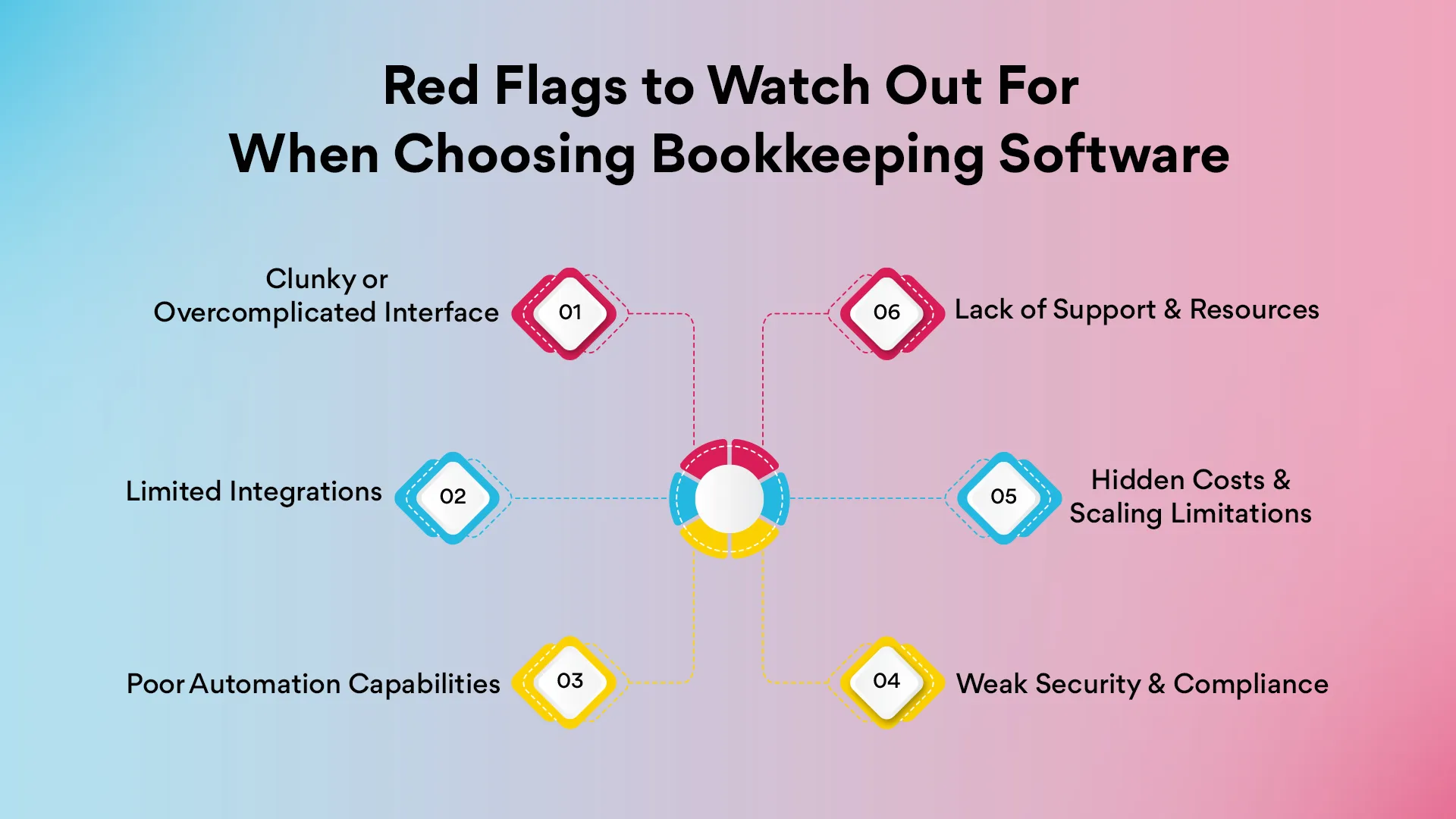

Red Flags to Watch Out For When Choosing Bookkeeping Software

Choosing the wrong bookkeeping practice management software can turn your workflow into a nightmare faster than you can say “misplaced invoice.”

For accounting firms and CPA firms, the risks are even higher since the right system impacts everything from compliance to client relationships.

Here are the warning signs to watch for:

1. Clunky or Overcomplicated Interface

If your team needs a PhD to figure out how to log a simple invoice, it’s a problem. Productivity won’t magically improve just because the software is “feature-rich.”

2. Limited Integrations

Software that doesn’t play nicely with your existing tools (email, CRM, accounting software, time tracking apps) will force you to jump between platforms and manually move data...the exact chaos you’re trying to avoid.

3. Poor Automation Capabilities

If every task still needs manual input, you’re basically paying for a glorified spreadsheet. Automation is the core of modern accounting software...anything less is a red flag.

4. Weak Security & Compliance

- Client data is sensitive. Software without encryption, audit trails, or a secure Client Portal is a liability waiting to happen. Don’t risk your reputation and your clients’ trust.

5. Hidden Costs & Scaling Limitations

Cheap upfront pricing can be deceiving. Watch out for per-user fees, add-on charges, or limits that make scaling impossible as your firm grows.

6. Lack of Support & Resources

When things break (and they will), you need responsive customer support. A slow or unhelpful support team can turn minor issues into full-blown disasters.

Pro Tip: The right solution should make your life easier, not add headaches.

If you spot more than one of these red flags, it’s a strong sign to move on...

And maybe take a closer look at tools like Xenett, which integrate, automate, and simplify...

Helping CPA firms and accounting firms strengthen workflows and build better client relationships without the hidden surprises.

How Xenett Fits Into the Picture: Your Accounting Superpower

So, you've sifted through the sea of accounting tools, weighed the pros and cons, and now you're wondering, "Is there a one-stop solution that ties everything together?"

Enter Xenett,

The bookkeeping solution built for accounting practice management, designed to streamline workflows, enhance accuracy, and reduce the chaos of manual processes.

It’s the kind of tool accounting firms can rely on to bring order, efficiency, and scalability to their day-to-day operations.

1. AI-Powered Error Detection

Remember those pesky errors that sneak into your financial statements?

Xenett employs AI to automatically detect over 50 common accounting errors, ensuring your books are accurate and compliant without the manual hassle.

It's like having a vigilant assistant who never sleeps.

2. Seamless Integration with QuickBooks and Xero

No need to abandon your trusted tools.

Xenett integrates smoothly with QuickBooks Online and Xero, enhancing their capabilities with automated reviews and real-time error alerts.

It's the perfect synergy for efficient accounting.

3. Automated Month-End and Year-End Close

Say goodbye to the stress of month-end and year-end closings.

Xenett automates these processes, tracking reconciliation statuses and providing a centralized view of your financials.

This automation not only saves time but also reduces the risk of errors during critical periods.

4. Streamlined Workflow Management

Whether it's onboarding new clients, conducting clean-up projects, or managing migrations, Xenett's workflow management tools keep everything organized.

With features like recurring tasks and board views, you can ensure that no task falls through the cracks.

5. Real-Time Client Collaboration

Communication is key, and Xenett facilitates this with its client portal. Share documents, raise queries, and keep clients in the loop, all within a secure environment.

This transparency fosters trust and enhances client satisfaction.

6. Comprehensive Reporting and File Management

Generate detailed financial reports effortlessly and manage your documents in one place.

Xenett's reporting tools provide insightful analytics, while its file management system ensures that all client documents are organized and easily accessible.

Final Thoughts: Smarter Tools, Better Bookkeeping

Choosing the right practice management software in 2025 isn’t just about keeping your spreadsheets in check...

It’s about saving time, reducing errors, and delivering a seamless client experience.

With tools like Xenett!

Accounting firms can automate workflows, track time effortlessly, and stay on top of compliance, all while keeping teams productive and clients happy.

The right practice management solution also ensures your accounting practice management processes run smoothly, giving you more control and visibility.

Stop juggling multiple apps and start working smarter, not harder.

Your firm deserves tools that actually make life easier, so why wait?

.svg)