Blog Summary / Key Takeaways

- The month end close definition centers on finalizing activity, reconciling, adjusting, and confirming the P&L and balance sheet are review-ready.

- Month-end close accounting differs from bookkeeping. It proves the ledger makes sense as a whole.

- The purpose of month end close is reliable monthly reporting for decisions and stakeholders.

- Why month end close is important: it prevents hidden errors and reduces recurring cleanup.

- A strong close depends on balance sheet integrity, standardized review, and documented decisions.

- Xenett helps teams operationalize review-first close work with tasks, approvals, and visibility.

Month-End Close Meaning in Accounting

What “Closing the Month” Actually Means

Closing the month means you set a cutoff. You decide what belongs in this month. Then you prove the general ledger supports that decision.

In practice, teams do four things during month end close accounting.

- They stop the clock on the period.

- They catch missing activity.

- They correct the ledger with adjusting entries.

- They review results so reporting holds up.

This is where reality shows up. Late invoices arrive. Payroll posts after the fact. Revenue needs an adjustment. Accruals fill gaps.

A clean close also means you resolve differences. For example, the bank balance must match cash. If it does not, you find out why. You do not guess.

You also create financials leadership can rely on. That includes variance context. It also includes clear support for key balances.

Month-End Close vs. “Monthly Bookkeeping”

Bookkeeping records the activity. Month-end close explained in plain terms means you confirm the full set makes sense.

Here is the difference most teams feel in real life.

- Bookkeeping asks, “Did we enter it?”

- Month-end close accounting asks, “Does it belong here, and is it correct?”

Bookkeeping can finish and still leave risk behind. A close reduces that risk. It forces cutoff discipline and account logic.

If you manage multiple entities or clients, this difference gets bigger. One file can look fine. Another can hide errors in stale accounts.

What Is Month End Close in Accounting Used For?

Purpose of Month-End Close

The purpose of month end close is to create a monthly checkpoint you can trust. That checkpoint supports decisions and reporting.

Most teams use the close to achieve three outcomes.

- Measure performance with consistent periods.

- Track cash and working capital with confidence.

- Report to stakeholders without rework.

Stakeholders vary by business type. In-house teams report to owners, boards, and lenders. Firms report to clients and internal reviewers.

Lenders often expect timely, consistent statements. The SBA, for example, emphasizes accurate financial records for lending and compliance.

Why Month-End Close Is Important

Why month end close is important comes down to cause and effect. Weak closes create hidden errors. Strong closes catch issues early.

If the close is weak:

- Errors hide in the balance sheet.

- Variances look “off,” but no one knows why.

- The team spends next month fixing last month.

- Leaders make decisions on noisy numbers.

If the close is strong:

- You find problems before they compound.

- Reporting becomes repeatable.

- Review time drops because support is ready.

- Month-end feels calmer and more predictable.

A real example I have seen many times: prepaid expenses. Teams book the vendor bill. They forget the amortization. The P&L stays wrong for months. A close that includes a prepaid roll forward catches that in week one.

What “Good” Looks Like

A “good” close does not mean “fast at any cost.” It means reliable and repeatable. Speed follows.

High-level outcomes include:

- A consistent cutoff policy

- Reconciled cash and key balance sheet accounts

- Clear variance explanations for material changes

- Documented review, approval, and changes made

You also see better conversations with leaders. Instead of debating the numbers, you discuss what the numbers mean.

Month-End Close Overview: What Typically Happens

This month end close overview gives the shape of the work. It does not try to be a checklist. Teams run different playbooks.

Still, most closes follow the same logic. You focus on completeness, accuracy, consistency, and review.

Core Activity Categories

Completeness asks one question. Did all expected activity hit the books?

Teams look for missing items, such as:

- late vendor bills

- unbilled revenue

- payroll accruals

- credit card charges not yet posted

- inventory receipts not invoiced

Accuracy asks for proof. Do balances tie to support?

Support usually includes:

- bank recs

- subledger tie-outs

- aging reports

- schedules and rollforwards

- third-party statements

Consistency keeps classifications stable month to month. You apply the same rules to the same activity. Therefore, trends stay meaningful.

Review adds independent judgment. A reviewer checks the P&L and balance sheet behavior. They ask, “Does this make sense?”

The Month-End Close “Flow” in One Simple Framework

- Capture remaining period activity (cutoff discipline)

- Validate balances (reconciliations and support)

- Adjust to match reality (accruals/reclasses/allocations)

- Review accounts and flux (P&L and Balance Sheet)

- Report results with context (financials + explanations)

This flow matters because it protects review time. If you review too early, you review twice. If you adjust too late, you report wrong numbers.

Who Is Involved in the Month-End Close Process?

Typical Participants

Most teams split close work into preparation and review. That split reduces errors and bias.

Typical participants include:

- Bookkeepers / staff accountants: finalize postings, gather support, prepare schedules

- Senior accountant / reviewer / controller: performs account-level review, flux analysis, signoff

- Finance leader (CFO/VP Finance): ensures reporting readiness and narrative quality

- Operations / client contacts (in firms): provide missing invoices, approvals, or clarifications

In firms, you often add a manager role. They enforce standards across clients. They also protect reviewer bandwidth.

This table helps when close work stalls. You can point to who owns each decision. You can also set expectations with operations early.

How Month-End Close Connects to Financial Reporting

Month-End Close as the Input to Reporting

Close work feeds reporting. Reporting quality cannot exceed close quality. That is the link.

Financial statements depend on:

- period cutoff

- reconciliation integrity

- disciplined review of P&L and balance sheet behavior

If you skip those inputs, you still get statements. However, you lose confidence. Then every meeting becomes a numbers debate.

Common Reporting Outputs After Close

Most teams generate these reports after they close.

- P&L (income statement)

- Balance sheet

- Cash flow (often indirect and later)

- KPI dashboards tied back to closed numbers

Dashboards work best when they match the closed ledger. Otherwise, teams chase two versions of the truth.

For example, if revenue in the dashboard uses invoices and the P&L uses accruals, you must reconcile the difference. That takes time.

Where the Connection Fails

The connection usually fails in predictable ways.

- Teams report before review finishes.

- Teams “close” by checklist completion, not by account integrity.

- Teams explain variances without confirming postings.

I have also seen teams lock the period in the ERP too early. They do it to stop changes. However, they then post messy entries in the next month to fix the prior month. That breaks trends and confuses leadership.

A reliable close lets you lock the month for the right reason. You lock it because it is correct. Not because the calendar says so.

What Makes Month-End Close Hard?

The Most Common Failure Points

Month-end close gets hard when inputs arrive late and standards live in people’s heads.

Common failure points include:

- Late arriving source documents, like bills or payroll adjustments

- Unreconciled or stale balance sheet accounts

- Review standards that stay tribal knowledge

- Flux surprises found too late, which causes cleanup

A practical example: credit cards. Many teams reconcile bank accounts monthly. They leave credit cards for “later.” Then expenses drift and accruals miss. The balance sheet holds old liabilities. The P&L shows spikes.

“Fast Close” vs. “Reliable Close”

A fast close is not better if it increases corrections later. A reliable close reduces downstream changes.

Reliability comes from repeatable review standards. It does not come from heroics. It also does not come from “working late on day five.”

If you want both speed and quality, standardize review. Then remove friction. Then automate what you can.

Month-End Close Best Practices

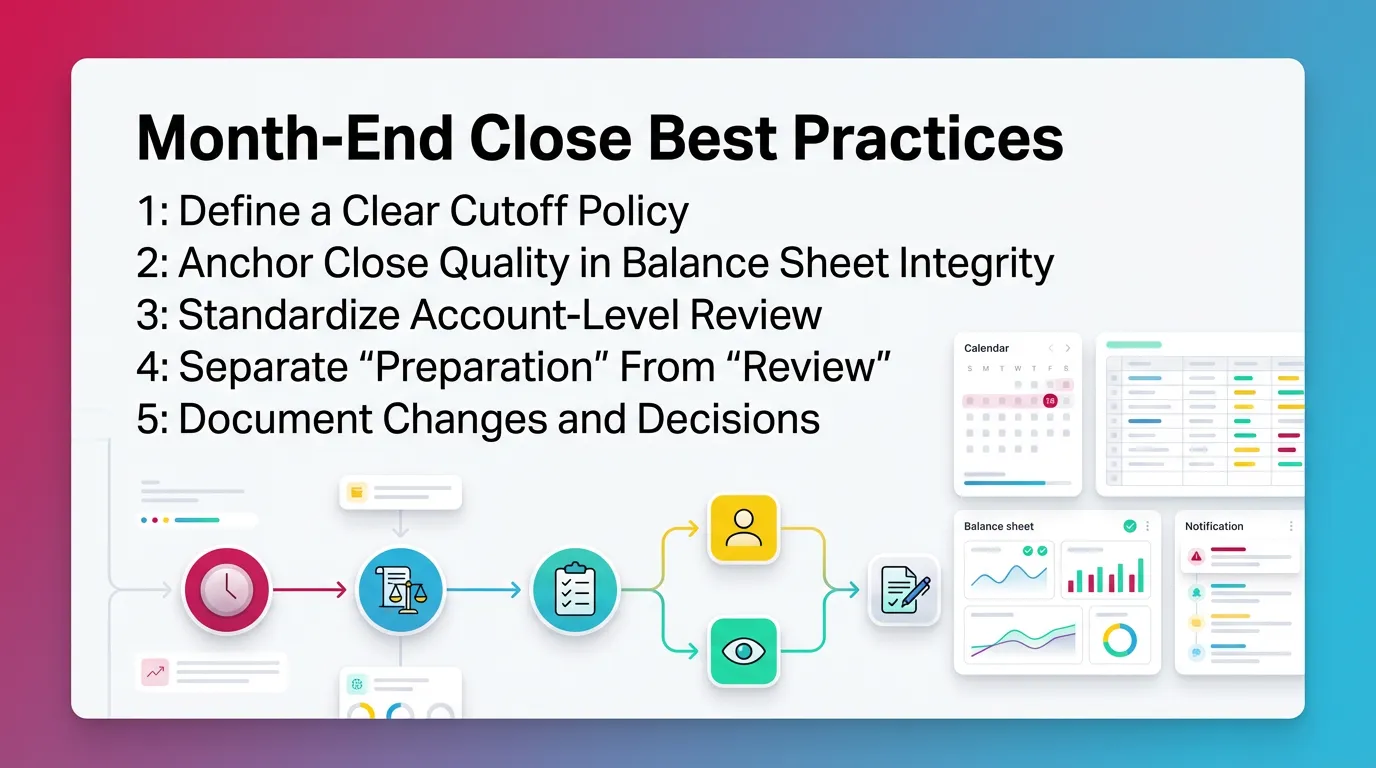

Best Practice 1: Define a Clear Cutoff Policy

Define what belongs in the month. Define what does not.

Your policy should answer:

- What invoice date rules you use

- How you treat late bills

- When you accrue payroll and bonuses

- When you book revenue adjustments

Write the policy down. Then follow it every month. That consistency makes trends real.

Best Practice 2: Anchor Close Quality in Balance Sheet Integrity

Treat reconciliations as proof. Do not treat them as a formality.

Tie every material balance to support, such as:

- bank statements for cash

- aging reports for AR and AP

- debt statements for loans

- schedules for prepaid and accrual accounts

If a balance has no support, it is not a balance. It is a guess.

Best Practice 3: Standardize Account-Level Review

Standardize what “reasonable” means for each material account. That removes subjectivity.

Set flux expectations, such as:

- review thresholds by dollar and percentage

- required explanations for top variances

- required tie-outs for key accounts

For example, you can require explanations for:

- any expense account over 10% and $5,000 month over month

- any balance sheet movement over $10,000 without a schedule

Choose thresholds that match your size. Then keep them stable.

Best Practice 4: Separate “Preparation” From “Review”

Reviewers should review. They should not rebuild schedules.

Protect reviewer time. Prep should include complete support and clear notes. Therefore, review becomes judgment work.

This one change often cuts close time. It also improves training. Staff learn what “good support” looks like.

Best Practice 5: Document Changes and Decisions

Document why you made entries. Document what they fixed.

Use a simple standard:

- what changed

- why it changed

- who approved it

- what support backs it

This is not about audits. It is about repeatability and accountability. It also helps when staff turnover happens.

Common Month-End Close Mistakes

Mistake 1: Treating the Close as a Deadline, Not a Quality Gate

If you treat close as a date, quality suffers. Then you pay the price later.

Cost includes:

- recurring rework

- fragile reporting

- growing exception backlog

Mistake 2: Over-Indexing on Checklists Without Account Logic

Checklists help. However, they do not replace thinking.

Cost includes:

- “everything checked” but numbers still wrong

- reviewers spending time hunting basic support

- leadership losing trust in the package

Mistake 3: Reviewing Only the P&L

P&L-only review misses persistent misstatements. Many problems live in the balance sheet.

Cost includes:

- errors that stay hidden for months

- surprise write-offs during year-end

- hard-to-explain working capital swings

Mistake 4: No Consistent Flux Thresholds

If you do not define materiality for review, you get inconsistent reviews.

Cost includes:

- variance explanations that change by reviewer

- wasted time on immaterial noise

- missed focus on high-risk accounts

How Xenett Supports a More Controlled Month-End Close

Turning Best Practices Into a Repeatable Close System

Teams often know what to do. They struggle to do it the same way every month. This is where Xenett fits as an operational layer for close and review.

Close task and checklist management

Xenett centralizes close tasks that exist to resolve review findings. It helps teams avoid “checklist completion” as the finish line. It keeps the focus on account integrity.

Review and approval workflows

Xenett structures account-level review of the P&L and balance sheet. Reviewers can sign off with consistency. Teams can see who reviewed what, and when.

Visibility into close status and bottlenecks

Xenett shows where close work actually stalls. For example, it can highlight specific accounts with missing support. That helps teams prioritize by risk and materiality.

Important clarification: Xenett is not an audit tool. It does not provide audit services. It supports accounting workflow, review, and close management.

Practical Use Case Examples

- Detect unusual account flux early, before reporting goes out.

- Enforce consistent review expectations across many client files.

- Reduce late-stage cleanup by routing findings to owners fast.

Month-End Close Summary

FAQ: Month-End Close

What is the month-end close?

Month-end close is the process of finalizing a month’s financial activity by verifying transactions, completing reconciliations and adjustments, and confirming accounts are ready for reporting.

What is month-end close in accounting?

What is month end close in accounting? It is the period-end discipline used to ensure the general ledger reflects the month accurately so financial statements can be issued with confidence.

What does month-end close mean?

Month end close meaning is simple. It means the accounting team has set a cutoff and completed the validation and review needed to rely on that month’s numbers.

What is the purpose of month-end close?

The purpose of month end close is to produce accurate, consistent financial statements and reduce errors by catching issues at a predictable monthly checkpoint.

Why is month-end close important?

Why month end close is important comes down to trust. Financial decisions and stakeholder reporting depend on numbers that are complete, supported, and reviewed.

Who is responsible for month-end close?

Accounting owns it. Staff accountants or bookkeepers prepare and reconcile. A controller or senior reviewer reviews and signs off. Operations supports with documents and approvals.

What reports are generated at month end?

Most teams generate the P&L and balance sheet. Many also generate a reporting package with cash flow, KPI dashboards, and variance explanations tied to closed numbers.

How long should month-end close take?

It depends on complexity and volume. Many organizations target a close measured in business days, not weeks, without compromising review quality.

Is month-end close the same as financial close?

No. Month-end close is a monthly subset of the broader financial close discipline. Financial close can also include quarter-end and year-end requirements.

Conclusion

What is the Month End Close? It is your monthly quality gate for the general ledger. When you run it well, you reduce rework and improve trust in reporting.

Review your cutoff policy this month. Then tighten one balance sheet reconciliation that stays stale. If you need a more consistent review system, document standards and manage review work in Xenett.

.svg)